Understanding GAP Insurance: What It Is & Why It Matters

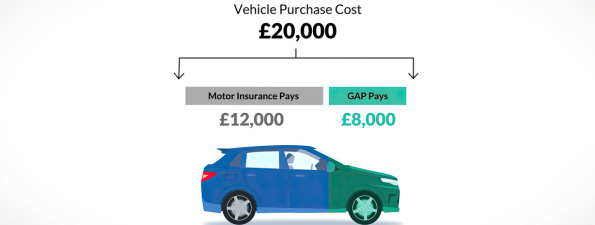

When your car is written off, standard motor insurance will usually only pay out the current market value of the vehicle – which can be significantly less than what you paid for it or still owe on finance. That’s where GAP Insurance comes in.

MotorEasy offer 3 different types of GAP Insurance – Return to Invoice (RTI), Return to Value (RTV), and Contract Hire & Lease (CHG).

Each cover is slightly different, depending on the age of your vehicle and purchase type. RTI GAP Insurance is the most popular cover option.

This page is for informational purposes only, if you’d like to see our dedicated GAP page click here, or ot get a quick qutoe there's a link at the bottom to take you there.

To Summarise:

- What GAP Insurance does: It bridges the 'gap' between your standard motor insurer's payout and either what you originally paid for the car, or the outstanding finance you still owe.

- Why it exists: Cars depreciate quickly - especially in the first few years - meaning the insurance payout can be much lower than expected. GAP Insurance helps prevent you being left out of pocket if your car's written off.

- Who it's useful for: Drivers with new, used, financed or leased vehicles - anyone who would feel the financial impact of a lower payout.

- Types of GAP Insurance: Return to Invoice, Return to Value, Contract Hire & Lease - all depending on how your car was bought and the outcome you want from protection.

Want a GAP Insurance Quote?

If after watching this video you feel like GAP Insurance might be right for you, you can get a quote in minutes to see options based on your vehicle and circumstances.